Surveys – what you need to know

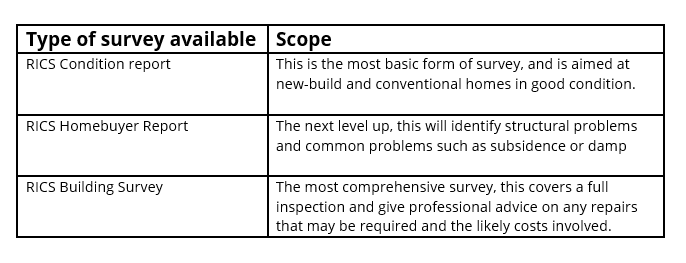

Having a survey carried out on a property before you commit to buying it makes financial sense, as it can save you thousands of pounds in repair bills. There are various options available, and we can offer help and advice on choosing the type that meets your needs.

A mortgage valuation isn’t the same as a structural survey. A mortgage valuation is undertaken by your lender to assess whether the property you want to buy is sufficient security for your loan. It won’t tell you about the state of the property or show up any underlying faults in the way that a survey does.